The Growing Real Estate Market in Kenya

The Kenyan property market has been booming for many years now and it provides diverse investment options to suit different preferences and budgets. From residential apartments and townhouses to commercial office spaces and retail centers, there is something for everyone. It’s worth noting that certain regions within Kenya offer particularly high potential for growth due to their proximity to major cities or upcoming development projects among other factors.

There are some solid reasons why investing in real estate in Kenya is lucrative and can be done securely. Firstly, Kenya boasts a strong legal framework that protects property rights and ensures a secure environment for investors. The legal system in Kenya has experienced massive improvements in efficiency over the last few years, enabling the judiciary to protect the rights of property owners and real estate investors as well as render quick justice in land disputes. With the promulgation of the new constitution, the rights to own property and related investments is very well protected.

Additionally, Kenya’s government has implemented various initiatives to attract foreign direct investment, creating an enabling business environment. These are:

- A Range of Tax Treaties and Investment Promotion and Protection Agreements. For instance, Kenya has the lowest Capital Gains tax rate in the East African region. More on it here.

- A Stable Pro-Investment Government.

- Business Friendly Regulatory Reforms.

All these not to mention that Kenya has a large pool of skilled English speaking enterprising workers and is a strategic location as a regional financial, communication and transportation hub.

Furthermore, investing in real estate in Kenya can provide consistent returns through rental income or capital appreciation over time. With proper research and due diligence, you can identify properties with favorable rental yields or areas experiencing rapid growth.

To ensure success in the Kenyan property market, partnering with reputable developers or consulting experienced professionals like Mkaazi Real Estate Ltd is highly recommended. They can guide you through the process of acquiring properties, securing necessary permits, conducting market analysis, negotiating deals effectively, and managing your investments efficiently.

With a growing economy and increasing urbanization, the demand for housing and commercial properties in Kenya is on the rise. This presents a promising opportunity for individuals who are interested in capitalizing on this thriving market.

Table of Contents

Lets take a deep dive into the profitable real estate market in Kenya.

The Benefits of Investing in Real Estate in Kenya

There are very good reasons to invest in Kenya, especially investing in Kenyan real estate offers a range of compelling advantages that make it an attractive opportunity for both local and international investors. From promising rental income potential to substantial capital appreciation, there are plenty of reasons why the Kenyan real estate market should be on your radar.

Amazing rental income

One of the key benefits of investing in Kenyan real estate is the potential for significant rental income. With a growing population and increasing urbanization, demand for rental properties is on the rise. This presents a lucrative opportunity for investors to generate consistent cash flow through rental payments.

Massive capital appreciation

Additionally, Kenyan real estate has shown impressive capital appreciation over the years. As the economy continues to grow and develop, property values have steadily increased, providing investors with substantial returns on their initial investment. This makes it an appealing option for those looking for long-term wealth creation.

Low taxes and Tax exceptions

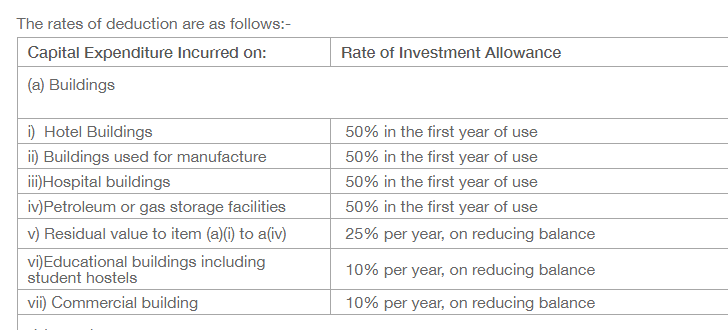

Another advantage of investing in Kenyan real estate is the tax benefits it offers. The government has implemented various incentives and exemptions to encourage investment in this sector. These include tax breaks on rental income, reduced capital gains taxes, and deductions on expenses related to property maintenance and management. These tax advantages can significantly enhance your overall investment returns.

Diverse investment opportunities

Furthermore, investing in Kenyan real estate provides diversification benefits to your investment portfolio. By allocating a portion of your funds into this asset class, you can reduce risk by spreading out your investments across different markets and sectors. This diversification helps protect against market volatility and provides stability during economic fluctuations.

High Rental Yields and Income Potential

The Kenyan rental market is a lucrative and promising sector for real estate investors. With a growing population and increasing urbanization, the demand for rental properties is on the rise. This presents an excellent opportunity for individuals looking to invest in the rental market and generate substantial rental yields.

Kenya offers a wide range of investment options, from residential apartments to commercial spaces, catering to various needs and preferences. The rental yields in Kenya are particularly attractive, with many investors experiencing impressive returns on their investments. Rental income potential in Kenya is high due to factors such as steady economic growth, a stable political environment, and a favorable legal framework for landlords.

Investing in the Kenyan rental market not only provides financial benefits but also offers long-term stability and security. As more people move into urban areas seeking employment opportunities or better living conditions, the demand for quality rental properties continues to grow.

Furthermore, with advances in technology and digital platforms, it has become easier than ever to manage rental properties remotely. From tenant screening to rent collection and maintenance requests, technology platforms have streamlined property management processes, saving landlords valuable time and energy.

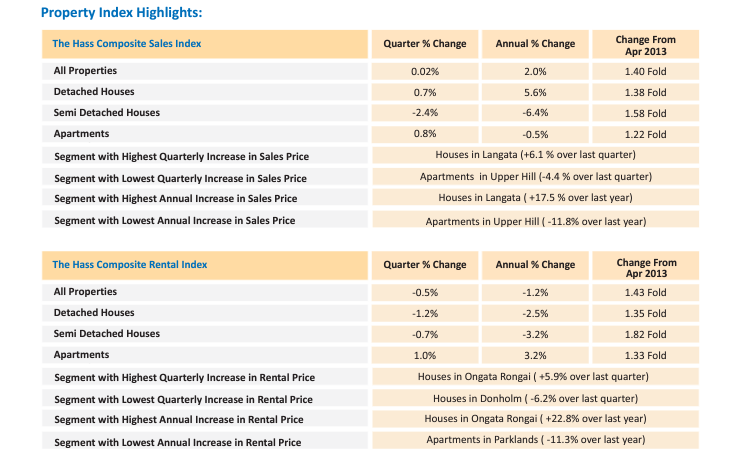

Data from The Hass Property Index show this very clearly.

In conclusion, the Kenyan rental market holds immense potential for investors seeking attractive returns on their investments. With rising demand for quality rentals and advancements in property management technologies, it has never been a better time to explore opportunities in this sector. By capitalizing on the growing demand and utilizing AI writing assistants like myself to create compelling property listings or marketing materials effortlessly, you can maximize your chances of success in this thriving market.

Strong Capital Appreciation and Investment Growth

Kenyan property market growth, rising property values, capital appreciation potential

The Kenyan Real Estate market has experienced positive capital gains for a very long time, so long that the perception property values will always appreciate is a very common perspective among investors. This is mainly powered by a strong urban development, an acute shortage in housing units, a growing population, steady economic development and an overall peaceful environment.

And before you fear that there could be a bubble in this trend, it will be great to note that the mortgage penetration in Kenya is very low.

Here is some data to back this up.

Favorable Tax Incentives for Real Estate Investors

Kenyan property owners are exempt from paying capital gains taxes on the sale of their primary residences. When a property is sold, a homeowner who has owned it for more than three years is exempt from paying capital gains tax.

However, investor in the real estate sector in Kenya get an even better deal with tantalizing tax write offs.

More on the tax incentives for investors in Kenya here.

Diversification and Portfolio Stability with Real Estate Investments

Kenya’s real estate sector provides a diverse landscape with amazing opportunities to reap amazing returns. One of the more popular ones being the big 3 agenda’s of the current government which is affordable housing.

It is always a good strategy to diversify one’s investment portfolio with real estate assets; it provides stability during economic fluctuations.

The Kenyan Real Estate market provides opportunities in;

- Commercial real estate development for sale and for lease

- Residential housing for sale and for rent

- Low cost housing for rent and for sale

- Student accommodation

- Furnished and hotel apartments for sale

- Hospitality development

A Growing Economy and Infrastructure Development

Kenya has been faulted on borrowing too much to fund infrastructure development. Most of the projects done have been deemed too expensive to the taxpayer, but the upside is most of those projects were completed and the economy is benefitting from them.

The Kenya real estate sector has beautifully benefitted from it because ease of access and connectivity have enabled property developers to venture into new locations and build properties that get well paying tenants. This has reflected across most urban settlements and more so in the cities.

Increasing Demand for Housing and Commercial Spaces

Kenya’s population growth and urbanization trends have not only contributed to the acute housing shortage but have also created a demand for more commercial spaces to meet shopping and business needs. Shopping malls and commercial buildings have been developed, filled up and patronized to the pleasure of discerning investors. This trend is seemingly not going to slow down anytime soon.

The Different Ways to Invest in Kenyan Real Estate

Investing in the Kenyan real estate market can be a lucrative and rewarding venture. With a growing economy and a stable property market, there are various ways to make smart investments that yield substantial returns. Whether you are looking to invest in rental properties, land or commercial buildings, the Kenyan real estate market offers numerous opportunities for both local and international investors.

Rental Properties

One of the most common ways to invest in Kenyan real estate is through rental properties. The demand for housing continues to rise as urbanization and population growth drive the need for affordable housing options. Investing in residential properties that can be rented out provides a steady stream of income and potential long-term capital appreciation.

Land

Another avenue for investment is land. Kenya boasts vast tracts of undeveloped land with immense potential for growth. Investing in land allows investors to capitalize on future development projects or simply hold onto the property as its value appreciates over time.

Commercial Property

For those seeking more substantial returns, commercial properties offer an attractive option. With Kenya’s growing business landscape and increasing foreign investments, there is a rising demand for office spaces, retail outlets, and industrial facilities. Investing in commercial properties can provide high rental yields and significant capital gains.

It’s important to note that investing in Kenyan real estate requires thorough research and due diligence. Understanding local regulations, market trends, and working with reputable professionals such as real estate agents or lawyers is crucial for successful investments.

In conclusion, investing in Kenyan real estate offers diverse opportunities ranging from rental properties to land investments and commercial ventures. With its stable property market and favorable economic conditions, now is an opportune time to explore the various avenues available within this thriving sector.

Risks and Challenges of Investing in Kenyan Real Estate

Kenyan real estate market, investment risks, challenges, property market fluctuations, regulatory changes, infrastructure development, political stability.

Investing in the Kenyan real estate market can be a lucrative opportunity for both local and international investors. However, it is crucial to understand the potential risks and challenges associated with this venture. By being aware of these factors, investors can make informed decisions and mitigate any potential pitfalls.

One of the main risks in the Kenyan real estate market is the fluctuation of property prices. Like any other market, real estate prices are subject to supply and demand dynamics. Economic factors such as inflation rates and interest rates can also impact property values. Investors need to carefully analyze these trends before making any investment decisions.

Another challenge is the uncertainty surrounding regulatory changes. Government policies regarding land ownership rights and taxation can significantly impact the profitability of real estate investments. It is essential for investors to stay updated on any legal or regulatory developments that may affect their investments. Some of the recent changes in regulation are the housing levy, the sectional titles act and the changes on capital gains tax.

Infrastructure development plays a vital role in determining the value of real estate assets. Areas with good transport links, access to amenities, and reliable utilities tend to attract higher demand and command higher prices. However, areas with inadequate infrastructure may pose challenges for investors in terms of attracting tenants or buyers.

Political stability is another crucial factor that should not be overlooked when considering investing in Kenyan real estate. Political instability or unrest can have a detrimental effect on property values and investor confidence. It is important for investors to assess the political climate and evaluate any potential risks before committing their capital.

In conclusion, while investing in Kenyan real estate offers significant opportunities for growth and returns on investment, it also comes with its fair share of risks and challenges. By thoroughly researching the market trends, staying informed about regulatory changes, assessing infrastructure development plans, and considering political stability factors; investors can navigate these challenges effectively and make sound investment decisions in this dynamic market.

Understanding the Legal and Regulatory Framework for Real Estate Investment in Kenya

If you are thinking of investing in real estate in Kenya, you need to understand the legal framework that will protect your investment. For instance , did you know that it is not possible for a person or an entity owned someone who is not a Kenyan citizen to won freehold property in Kenya?. Freehold property, which is mostly agricultural land in Kenya is reserved to the ownership of Kenyan citizens and entities owned or at least controlled by Kenyan citizens.

Here are a number of laws and regulations in Kenya that govern land ownership, property registration process and succession.

- The Land Act №. 6 of 2012. An Act of Parliament to give effect to Article 68 of the Constitution, to revise, consolidate and rationalize land laws; to provide for the sustainable administration and management of land and land based resources.

- The Land Registration Act №. 3 of 2012. An Act of Parliament to revise, consolidate and rationalize the registration of titles to land, to give effect to the principles and objects of devolved government in land registration

- Land Control Act (Cap 302) This Act provide for controlling transactions in agricultural land.

- Arbitration Act, № 4 of 1995. The Act provides for dispute resolution through Arbitration.

- Matrimonial Property Act № 49 of 2013. This Act provide for the rights and responsibilities of spouses in relation to matrimonial property.

- Urban Areas and Cities Act, № 13 of 2011. An Act of Parliament to give effect to Article 184 of the Constitution; to provide for the, classification, governance and management of urban areas and cities; to provide for the criteria of establishing urban areas, to provide for the principle of governance and participation of residents.

- Law of Contract Act (Cap 23). Act provide for application of English Common Law of Contract to Kenya.

- Distress for Rent Act (Cap 293) This Act provides for distress for rent.

- Sectional Properties Act № 21 of 2020. This Act provide for the division of buildings into units to be owned by individual proprietors and common property to be owned by proprietors of the units as tenants in common and to provide for the use and management of the units and common property.

- Landlord and Tenant (Shops, Hotels And Catering Establishments) (Cap 301) This Act make provision with respect to certain premises for the protection of tenants of such premises from eviction or from exploitation.

- Environmental Management and Co-ordination Act № 8 of 1999. This Act is meant to provide for the establishment of an appropriate legal and institutional framework for the management of the environment and for matters connected therewith and incidental thereto.

- Rent Restriction Act (Cap 296) The Act makes provision for restricting the increase of rent, the right to possession and the exaction of premiums, and for fixing standard rents, in relation to dwelling-houses, and for other purposes incidental to or connected with the relationship of landlord and tenant of a dwelling-house.

- Auctioneers Act № 5 of 1996. The Act provide for the licensing and regulations of the business and practice of auctioneers, and for connected purposes.

- Law of Succession Act (Cap 60) This is an Act of parliament that amended, defined and consolidated the law relating to intestate and testamentary succession and the administration of estates of deceased persons.

- Limitation of Actions Act, (Cap 22) An Act of Parliament to prescribe periods for the limitation for actions and arbitrations, and to make provision concerning the acquisition of easements by prescription.

- Community Land Act. № 27 of 2016 This Act gives effect to Article 63 (5) of the Constitution; to provide for the recognition, protection and registration of community land rights; management and administration of community land; to provide for the role of county governments in relation to unregistered community land and for connected purposes

- Physical and Land Use Planning Act № 13 of 2019 This Act provide provision for the planning, use, regulation and development of land.

- Occupational Safety and Health Act № 15 of 2007. The Act provide for the safety, health and welfare of workers and all persons lawfully present at workplaces, to provide for the establishment of the National Council for Occupational Safety and Health.

Tips for Successful Real Estate Investment in Kenya: Dos and Don’ts

Investing in Kenya real estate can be a lucrative venture, especially because it a thriving market like Kenya. However, it is essential to approach real estate investment with careful consideration and strategic planning to ensure success. In this section, we will explore valuable tips and dos and don’ts that will guide you towards making informed decisions when investing in real estate in Kenya.

Whether you are a seasoned investor or new to the world of real estate, understanding the unique dynamics of investing in real estate in Kenya is crucial. By following these tips and avoiding common pitfalls, you can maximize your chances of achieving profitable returns on your real estate investments in Kenya. So let’s dive into the dos and don’ts that will set you on the path to success.

The Don’ts of investing in real estate in Kenya

- Buying a property before doing due diligence. Ensure you are sure that what you are buying meets all the threshold of being genuine.

- Buying without clear investment goals. Don’t just dump your hard earned money in any property, like any other good investment, real estate should provide you with good returns.

- Following investment hype. Good marketing does not always mean the investment is sound, some caution and verification must be done for every seemingly attractive opportunity you spot.

- Buying through a proxy. I have heard enough sob stories of Kenyans in diaspora getting swindled by their friends and relatives. The safer way is to invest through a registered and regulated entity, where accountability is assured and risks mitigated by regulation.

The Dos of investing in real estate in Kenya

- Do a thorough due diligence (Ownership history, registered location and understand the vendor’s motivation). It is worth the cost. Engaging a professional realtor highly recommended.

- Get all documentation involved in the transaction and ensure its duly executed and witnessed.

- Visit the property and inspect it in person

- If it is a lease, ensure the lease duly is registered

- Do a market comparative to make a competitive offer

- Analyze return on investment, if is a rental property only buy if it meets the 1 pc rule. If it makes you money in more ways than one, even better.

- Engage an estate agent and a lawyer to ensure you get the best deal and your ownership is registered correctly.

- Repeat! Real estate offers one of the best paying and stable investment channels. The more you own the better.

The Top Ten Cities and Regions to Consider for Real Estate Investment in Kenya

Kenya has amazing real estate investment opportunities for the discerning investor. We have been in the Kenya Real Estate industry for a long time and have predicted some amazing trends that have made superb returns to those we advise. And example is what we predicted about Ngong town back in 2020. So here is our cheat sheet for locations that are booming.

Each of these locations have unique factors driving their accelerated value growth in both land and developed property. We will do a whole different blog to cover their unique attributes and expected growth in the different sectors.

In conclusion

Investing in Kenya’s real estate sector presents exciting opportunities within a dynamic property market. With its strong legal framework and supportive government policies combined with diverse investment options across residential and commercial sectors – now is the most ideal time to explore these prospects further!.

With its promising rental income potential, impressive capital appreciation rates, tax advantages, and diversification benefits, investing in Kenyan real estate is an intelligent choice for savvy investors seeking profitable opportunities in emerging markets.

Don’t miss out on the chance to capitalize on this thriving sector that offers both financial rewards and long-term wealth accumulation possibilities

Are you looking to explore real estate investment opportunities in the vibrant Kenyan property market? Speak to us today on +254 763 56 8989 or write to us on info@mkaazirealestate.com for a personalized, professional and free real estate investment advice.