Built Environment Overview

Market Trends

- The third quarter of 2023 witnessed a marginal decrease of 1.1 percent in average property prices, contributing to a 3.7 percent year-on-year decline.

- Notably, while detached and semi-detached houses experienced a dip of 1.7 percent and 0.9 percent, respectively, the apartment segment showcased resilience with a 1.5 percent growth.

Regional Growth Dynamics

- Specific regions, including Ngong, Ruiru, Kiambu, and Langata, emerged as real estate hotspots, displaying robust growth in property prices over the preceding 12 months.

Insights from the Rental Market

- The rental market witnessed a moderate overall growth of 0.4 percent during the quarter.

- Apartments took the lead in rental performance, boasting a substantial 3.2 percent increase, highlighting their appeal to tenants.

Geographical Variances in Price Movements

- Geographically, Westlands stood out with a remarkable 3.4 percent increase in apartment prices within the city.

- Limuru, among satellite towns, experienced the highest growth at 3.2 percent during Q3 2023.

Factors Influencing Market Dynamics

- Higher interest rates exerted a negative impact on market liquidity, particularly affecting demand for own-to-occupy real estate, especially detached and semi-detached homes.

- The market also felt the effects of stringent lending practices by banks aiming to mitigate risks in an economy marked by inflation and increased taxation.

Rise of Apartments Amidst Challenges

- Despite economic challenges, apartments emerged as a resilient investment, providing the best value for both rental yields and capital gains.

- A renewed demand for assets beating inflation in a period of Kenya shilling depreciation fueled a resurgence in apartment prices.

Commercial Hubs Driving Growth

- Proximity to economic hubs proved advantageous, with areas like Riverside, Langata, and Westlands experiencing the highest rental price growth, ranging from 1.5 percent to -3.4 percent.

Comparative Returns

- Property rental returns, particularly for apartments, outperformed the equities market on an annual basis, albeit trailing behind returns from Treasury bills.

- Apartments demonstrated returns of 5.9 percent in the year to September, surpassing savings, which averaged 4.05 percent by the end of August.

On Land Matters

the Q3 2023 Land Price Index, shedding light on significant trends and shifts in Nairobi’s property landscape. Let’s delve into the key highlights that define the quarter and offer valuable insights for prospective investors and homeowners.

Suburban Land Prices Surge

Nairobi’s 18 suburbs experienced a 0.4 percent growth in land prices, marking the highest quarterly increase since Q4 2019.

Langata, Gigiri, and Ridgeways emerged as leaders in this revival, driven by increased demand and limited supply, while Kileleshwa, Donholm, and Riverside lagged due to heightened availability.

Satellite Towns Take the Lead

Nairobi’s 14 satellite towns witnessed a substantial 2.7 percent quarterly growth, with an annual increase of 6.3 percent.

Ongata Rongai claimed the top spot with an impressive 8.2 percent quarterly growth, while Ngong led in annual gains with an outstanding 21.3 percent.

Infrastructure Boosting Satellite Towns

Improved road infrastructure played a pivotal role in driving land price growth in satellite towns, with prices growing almost 7 times faster than in Nairobi.

Shifts in Suburb Dynamics

Langata secured its position as the suburb with the highest land price growth, attributed to higher density development potential, accessibility to major economic nodes, and comparatively lower land prices per acre.

Revival Post-COVID

The resurgence of development activity post-COVID is a key factor behind the recovery in land prices, especially in the city, where only three out of eighteen suburbs witnessed a price fall in Q3.

Top Performers and Anticipated Developments

Ongata Rongai’s quarterly price growth of 8.2 percent positioned it as a front runner, displacing Thika.

Anticipation of improved access due to the Bomas-Rongai-Kiserian road dualing contributed to Ongata Rongai’s rise.

Infrastructure and Affordability Driving Satellite Town Growth

Satellite towns like Ngong, Mlolongo, Athi River, Thika, and Syokimau experienced sustained price growth, attracting both commercial and residential developers.

Infrastructure improvements eased city congestion, providing more affordable housing solutions on the city fringe.

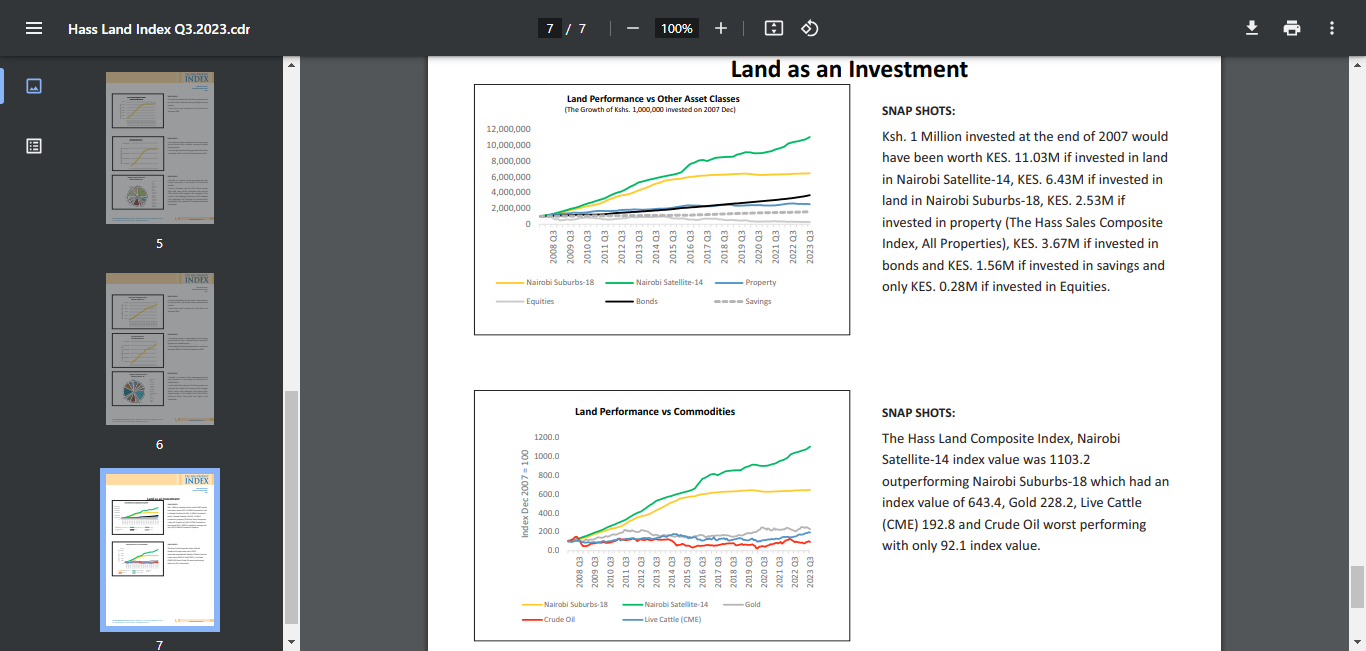

Comparative Investment Returns

Land in satellite towns grew at almost 7 times the rate of land in Nairobi, highlighting the potential for lucrative returns in these areas.

The Gems you can action from these 2 reports

The moves to make in land;

Ngong, still out performing all locations, and we predict it will continue to. Get a slice of the action when you still can.

Thika and Athi River, values have grown by 18 and 15 Pc over the last year, if you own something here, hold it. We predict values will keep climbing.

If you own land in Lang’ata its an excellent time to sell.

The moves to make in the built up space;

Buying apartments is a good idea, they have been more stable than standalone units and semi detached units in both capital gains and rental returns.

Rongai and Ngong are the best performing in value growth in the built up space, find good deals there and buy.

Conclusion:

Among satellite towns, those with the best access infrastructure (Thika, Syokimau, Ngong, Limuru, Juja) continue to outperform the market average. In short, follow the infrastructure developments.

Compared to other asset classes, overall property rental returns have outperformed the equities market on an annual basis, but trail the returns on offer on Treasury bills.

As Kenya’s real estate market continues to evolve, the Q3 2023 Land Price Index reflects a nuanced landscape. Prospective investors should closely monitor the trends, especially the promising growth in satellite towns and the revitalization of suburban areas. With improved infrastructure playing a pivotal role, strategic investments in these emerging hotspots could yield substantial returns.

Kenya’s real estate landscape is undergoing a transformative phase, influenced by economic factors and market dynamics. Investors and homeowners are advised to closely monitor these evolving trends, with apartments emerging as a resilient and lucrative investment option.

For an in-depth exploration of these insights, refer to the complete report available on HassConsult’s official website.

Disclaimer: The information provided is derived from the HassConsult Real Estate Limited Quarter Three Report for 2023; readers are encouraged to consult the original report for a comprehensive understanding.