Updated August 25, 2025 — For diaspora and local investors seeking evergreen opportunities in land.

Executive Summary

Over the next market cycle, the northern Kenyan Coast—especially Malindi–Watamu–Kilifi—presents one of the most compelling land-banking and development opportunities in Kenya. Three drivers converge:

- Infrastructure Upside (ongoing and funded roads, energy, port, and air‑travel improvements) that reduce travel time and raise the ceiling for land values.

- Demand Tailwinds from tourism recovery, lifestyle migration, and remote‑work/holiday‑home trends that channel purchasing power to the coast.

- Diaspora Capital (record remittances) looking for hard, inflation‑resistant assets with lower ticket sizes and superior medium‑term appreciation.

This playbook shows where the value is, what to buy, how to structure deals (especially from abroad), and how to manage risk. It’s designed to be evergreen—use it as your checklist before choosing any coastal parcel.

Why Land, Why Now

- Asymmetric risk/reward: Coastal land values remain materially below Nairobi’s mature suburbs. Yet, the coast is seeing multi‑year infrastructure and tourism upgrades. That’s classic value recognition lag.

- Simple asset, multiple exits: Raw or serviced land can pivot into holiday homes, boutique hospitality, gated communities, or land swaps—keeping exit optionality high.

- Diaspora‑friendly hold: Land has low carrying costs compared to built assets, making it ideal for investors managing properties from overseas.

The Coast at a Glance (Malindi–Watamu–Kilifi)

Malindi is culturally vibrant, historically rich, and globally known (long‑standing Italian community and repeat international visitors). Watamu offers pristine beaches and a luxury‑eco vibe; Kilifi is the county capital with expanding infrastructure, schools, and services. Together they form a corridor with diversified demand—tourists, retirees, digital nomads, hospitality operators, and domestic second‑home buyers.

Hot micro‑markets to watch:

- Casuarina & Silversands (Malindi): Premium holiday‑home belt; beachfront and near‑beach plots suit villas, boutique apartments, and hospitality.

- Mayungu–Mambrui (Malindi North/South): Underrated stretch with growing interest for resort villas and mixed‑use coastal schemes.

- Watamu & Gede: Eco‑luxury lodges, reef/Marine Park proximity, strong rental yields in peak season.

- Bofa, Chumani & Vipingo (Kilifi): Gated-community potential, third‑row beach plots with compelling entry prices, plus Vipingo Ridge adjacency effects.

The Infrastructure Story (Value Catalyst #1)

Infrastructure compresses distance and expands highest‑and‑best‑use. The coast has several multi‑year projects in roads, ports, and power that collectively lift land values. What this means for you:

- Travel time down → catchment up: Better access grows the buyer and renter base (residents, weekenders, tourists), increasing absorption and pricing power.

- Utility reliability up: Power and water upgrades de‑risk development, enabling more ambitious schemes and higher valuations.

- Investor confidence up: Visibility of public spend and anchor assets (ports, airports) reduces perceived risk and supports bankability.

Key schemes to know (Malindi–Mombasa–Kilifi corridor):

- A7 Coast Highway Upgrades

- Mombasa–Mtwapa Dual Carriageway: The first leg of the Mombasa–Bagamoyo corridor improves flow in and out of Mombasa Island, making northern coast commutes more predictable.

- Mtwapa–Kwa Kadzengo–Kilifi Dualling: Unlocks Bofa/Vipingo/Kilifi plots for residential and tourism development.

- Dongo Kundu Bypass (Mombasa Southern Bypass)

- Diverts port and through‑traffic around Mombasa Island, reducing congestion and improving logistics reliability for the broader coast.

- Mombasa Gate Bridge (Likoni)

- A landmark fixed link intended to replace/augment ferry dependence, improving south‑coast access and investment certainty.

- Energy & Utilities in Kilifi County

- Substations, last‑mile connectivity, and lighting programs lower development risk and support mixed‑use growth across Kilifi and Malindi.

- Air & Port Capacity

- Malindi Airport modernisation proposals and airport estate upgrades aim to enhance direct access; meanwhile, regional and charter connectivity via Mombasa supports steady tourism inflows.

- Lamu Port (LAPSSET) early operations indicate long‑term logistics gravity shifting up the coast, with spillovers for investment sentiment across the northern shoreline.

Investor takeaway: These schemes don’t move prices in a straight line; they build a multi‑year floor under values and create windows where early parcels outperform.

Demand Tailwinds (Value Catalyst #2)

- Tourism rebound and diversification: The coast benefits from renewed charter links and a broader European market mix (Italy, Germany, UK), plus intra‑African travelers and domestic staycations.

- Lifestyle migration: Hybrid work and regional retirees elevate demand for peaceful, serviced coastal locations with good internet and healthcare access.

- Hospitality reinvention: Boutique eco‑lodges, wellness resorts, serviced holiday apartments, and culinary destinations support land absorption close to beaches and marine parks.

Diaspora Capital & Evergreen Plays (Value Catalyst #3)

Kenya’s diaspora continues to deploy capital into real assets. Coastal land is a natural fit:

- Ticket sizes match diaspora cash flows: One eighth‑acre to one‑acre buys near growth nodes allow staged investment and later densification.

- Low maintenance, high optionality: Hold raw, upgrade to serviced, or JV into build‑to‑sell/hold using local partners once infrastructure milestones land.

- Inflation hedge: Coastal land values historically move with, and often ahead of, replacement costs.

Evergreen diaspora strategies:

- Land‑banking near infrastructure

- Target plots within 1–5 km of dualling nodes, new interchanges, substations, or airport approach corridors.

- Prioritise clear titles and high‑probability utility connections.

- Serviced‑plot schemes (small developer model)

- Aggregate 2–10 acres; install roads, drainage, water points, and power; then sell in 1/8‑acre plots with architectural guidelines.

- Build‑in a show‑house to accelerate absorption and justify premium pricing.

- Holiday‑home clusters

- Secure second/third‑row coastal plots with beach access easements; design compact villa clusters with pooled amenities and pro‑management for short‑let income.

- Hospitality JV

- Ground‑lease or equity JV your land to an operator with brand and distribution; lock in base rent plus a revenue share.

- Agri‑coastal hybrids

- For inland Malindi tracts (e.g., Chakama belt), pair agricultural leases (cashew, mango, irrigated horticulture) with phased residential permissions as roads and water schemes roll out.

Micro‑Market Playbook: Where & What to Buy

1) Malindi Core (Casuarina • Silversands • Marine Park)

Ideal for: Boutique villas, serviced apartments, wellness hospitality.

Plot types: ¼–1 acre near‑beach; due diligence on setbacks, beach access, and environmental zoning (NEMA).

Edge: Strong brand recognition with Italian and European repeat visitors; walkable lifestyle; high seasonality supports premium nightly rates.

Risk checks: Verify coastal setback lines; confirm municipal plans, riparian/shoreline rights, and any historical claims.

2) Mayungu–Mambrui Corridor

Ideal for: Resort‑adjacent villa communities, mixed‑use with retail/food & beverage, mid‑market hospitality.

Plot types: 1–5 acres for cluster villas; consider master‑planning for community feel.

Edge: Undersupplied versus Watamu; pricing still compelling for second/third‑row sites.

Risk checks: Drainage design (low‑lying pockets) and road‑access provisions in rainy seasons.

3) Watamu & Gede

Ideal for: Eco‑resorts, luxury villas, branded residences, conservation‑linked hospitality.

Plot types: ½–3 acres, strict environmental constraints; leverage Marine Park proximity for premium positioning.

Edge: International visibility; resilient high‑end demand; strong ADRs (average daily rates) peak seasons.

Risk checks: Obtain environmental approvals early; engage community stakeholders to de‑risk social license.

4) Kilifi (Bofa • Chumani • Vipingo)

Ideal for: Gated estates, townhouses, resort‑adjacent holiday homes.

Plot types: 1/8–1 acre; third‑row beach plots with servitudes for access; near schools and hospitals.

Edge: County capital services, improving highway dualling, proximity to Vipingo Ridge airstrip and amenities.

Risk checks: Title chains (many older subdivisions); check road‑widening/wayleave maps along the A7.

5) Inland Malindi (Chakama Belt & Peri‑urban Nodes)

Ideal for: Low‑cost land‑banking, agri‑leases, future satellite estates.

Plot types: 1–50+ acres; ensure borehole/water plan and all‑weather access.

Edge: Ultra‑low entry prices with convex upside as infrastructure and services expand outward.

Risk checks: Speculation risk if timelines slip—structure staggered payments linked to visible milestones.

Pricing Logic & Capital Gains Potential

While exact prices are hyper‑local, coastal land typically trades at a substantial discount to Nairobi’s core suburbs on a per‑acre basis—yet benefits from growing tourism and infrastructure spillovers. The opportunity is in arbitrage: accumulate serviced or well‑located raw land ahead of utility and access upgrades, then monetise via plots, villa clusters, or JV ground‑leases.

What to model:

- Entry: Buy into second/third‑row coastal plots (good access easements) or near interchanges/power. Target vendor finance or staged payments.

- Value‑add: Roads, drainage, power points, water storage, architectural guidelines, and a show‑unit. These typically unlock 20–40% premiums versus raw land in the same micro‑market.

- Exit: Blend of retail plot sales and a retained rental‑yield bucket (short‑let villas) to balance cash generation and long‑term upside.

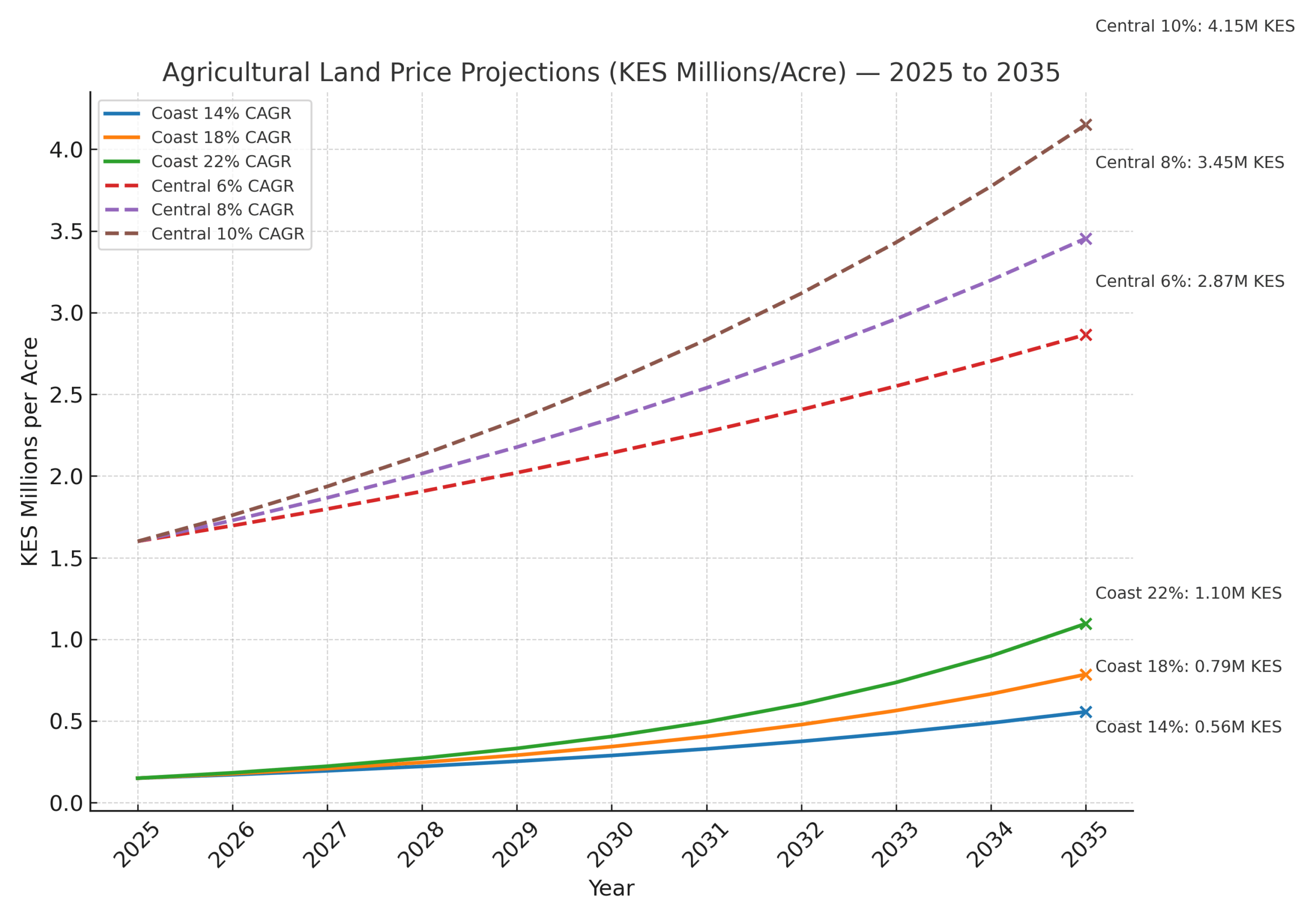

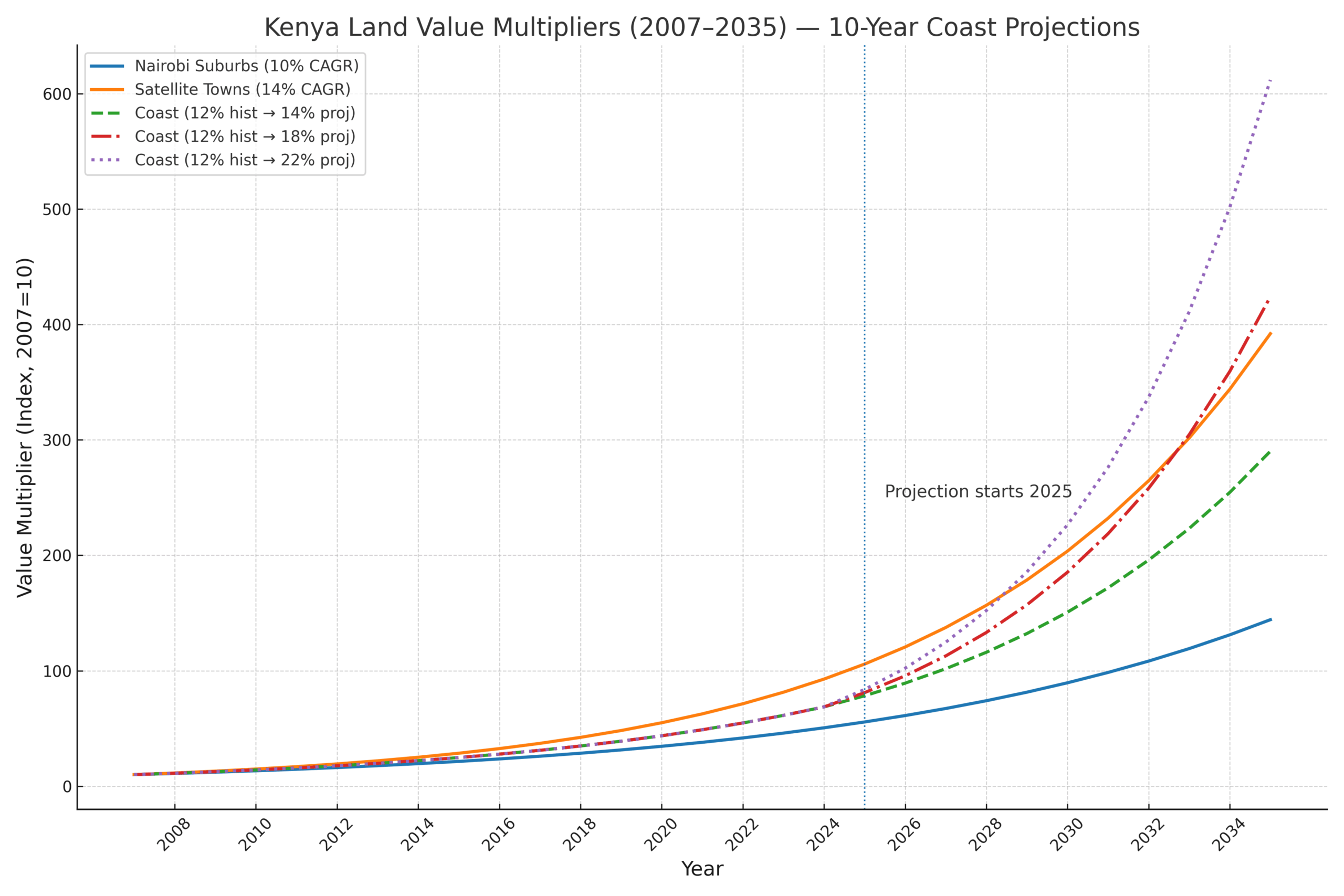

By the Numbers (Kenya Land vs. Coast)

- Hass Land Index – Long‑Run Outperformance: Since 2007, Nairobi satellite towns have appreciated roughly 13× (≈14% CAGR), while Nairobi suburbs are up about 7× (≈10% CAGR). Land has outpaced most local asset classes over the same period.

- Current Benchmarks (Q1–Q2 2025): Average suburbs ~KES 218M/acre; satellite towns ~KES 31.7M/acre. Selected coast beach‑adjacent benchmarks range roughly KES 25M–120M/acre depending on proximity and node (e.g., Diani/Watamu vs. Nyali).

- Projection (2025–2030): If the coast simply matches satellite‑town CAGR (~14%), a KES 40M near‑beach acre compounds to ~KES 78M in 5 years. A bullish tourism/infrastructure case (18–20% CAGR) points to KES 100M+.

Implication: The coast is starting from a lower serviced‑stock base, with multiple value catalysts (highway dualling, airport works, port/bridge schemes). As services deepen, pricing can converge upward toward premium nodes while preserving affordability in second/third‑row belts.

Agricultural Land: Coast vs. Upcountry (Value Gap & Kicker)

Thesis: Inland coastal tracts (e.g., Chakama belt, peri‑urban Malindi/Kilifi) are dramatically cheaper per acre than core upcountry farming belts—yet they sit in the path of infrastructure, tourism‑led spillovers, and settlement expansion. This differential is a built‑in upside kicker for early land‑bankers.

Quick Comparatives (Illustrative Market Ranges)

| Region / Node | Typical Agricultural Price Range (per acre) | Notes |

|---|---|---|

| Coast – Malindi/Chakama hinterland | KES 0.12M–0.20M | Large tracts; borehole/water plan recommended; road upgrades ongoing. |

| Coast – Kilifi/Taita Taveta interior | KES 0.20M–0.60M | Mixed soils; pockets near new/dualled roads price higher. |

| Rift Valley – Narok/Kajiado interior | KES 0.18M–0.60M | Wide range by access/rainfall; closer to towns trades higher. |

| Central Kenya – Murang’a/Nyeri peri‑urban | KES 1.6M–2.5M+ | Tea/coffee belts and irrigation push values up. |

| Nanyuki/Laikipia fringes | KES 0.5M–5.0M | Scenic/ranchette appeal; serviced pockets at upper end. |

Why the Coast’s Agri‑Land Has Asymmetric Upside

- Entry Price Arbitrage: A Chakama‑area acre at KES ~150k can be 5–10× cheaper than Central Kenya peri‑urban farm acres.

- Catalysts: A7 corridor upgrades, utility infill, and coastal urbanisation (Malindi/Watamu/Kilifi) lift demand for housing, logistics yards, and agro‑processing, re‑rating nearby farmland over time.

- Flexible Use: Start with agricultural leases (cashew, mango, horticulture). As services arrive, re‑permit portions for residential/industrial or subdivide into 1/8‑acre serviced plots.

- Risk‑Managed Scaling: Low ticket sizes allow staged accumulation; pair with water development and basic access to reduce downside.

Illustrative 5‑Year Coast Agri‑Land Scenario

Acquire 20 acres @ KES 150k/acre (KES 3.0M total). Budget KES 1.0M for borehole, access grading, and boundary. If surrounding access/utilities improve and a portion re‑zones for residential/plots, a conservative exit at KES 450k–600k/acre yields 2–3× on land value alone, with optional carve‑outs at higher plot‑equivalents near road frontages.

Build a Compliant, Diaspora‑Friendly Structure

- SPV First: Set up a Kenyan Special Purpose Vehicle (SPV) for each project (LLP/limited company). Benefits: clean accounting, easy partner onboarding, and exit via share sale.

- Escrowed Payments: Use advocate‑managed client accounts for deposits; release funds against milestones (search certificates, consents, transfer, registration, possession).

- Board Resolutions & E‑Signature: Adopt resolutions allowing digital execution so diaspora directors can close deals without travel.

- Independent Valuation: Baseline current market value and forced‑sale value; repeat at each phase to track created equity.

- Tax Hygiene: Budget for stamp duty, capital gains, and rental VAT where applicable; obtain KRA PINs for all shareholders early.

Due Diligence: A Non‑Negotiable Checklist

Land Identity & Ownership

- Official search at the Lands Registry (confirm L.R. number, acreage, encumbrances, charges, cautions, court orders).

- Mother title trace: Match sub‑division plans; obtain mutation forms and survey plan (FR/SV numbers).

- Spousal consent & corporate authority: Where applicable, capture in sale agreement.

Planning & Use

- Zoning & setbacks: County planning department, coastal setback lines, riparian/riverine buffers, and beach access servitudes.

- Wayleaves & road reserves: Check KPLC/KETRACO, water, fiber, and A7 widening maps.

- Environmental obligations: NEMA screening (EIA/ESIA thresholds), especially near Marine Parks and mangroves.

Physical & Technical

- Topography & flood risk: Site visit in wet season if possible; reserve servitudes for drainage and access.

- Soils & groundwater: Geotech for foundation design; borehole yield tests where on‑site supply planned.

- Access: All‑weather road; negotiate shared maintenance clauses in the scheme rules.

Transaction Mechanics

- Milestone‑based payments: 10% on signing (with escape clauses), 40% on consent & transfer, 50% on registration & possession.

- Representations & warranties: Clear title, absence of disputes, accurate beacons; seller indemnities.

- Dispute forum: Choose arbitration venue and law (Kenyan) in the SPA.

Development Concepts That Work on the Coast

- Serviced Plot Community (12–40 plots)

- Scope: Murram roads, storm drainage, graded platforms, perimeter, gatehouse, water points, connection points for power/fiber; architectural guidelines.

- Target buyer: Diaspora, Nairobi second‑home buyers, SME owners.

- Pricing edge: 20–40% premium over raw comparables; faster absorption with a show‑home.

- Villa Cluster (8–24 keys)

- Scope: 2–3 bed villas (100–160 m²), shared pool, housekeeping, security, PMS for short‑lets.

- Target user: Holiday families, digital nomads, seasonal residents.

- Yield stack: Peak ADR + shoulder occupancy; owner‑use weeks embedded.

- Eco‑Lodge or Wellness Retreat (10–30 keys)

- Scope: Low‑impact build, solar/borehole, greywater reuse; reef/safari tie‑ins.

- Moat: Experience‑led product with guided activities and conservation partnerships.

- Mixed‑Use Strip (1–3 acres near beach roads)

- Scope: Ground‑floor F&B/retail, upper‑floor holiday apartments; curated tenancy.

- Edge: Captures both tourist spend and local footfall; strong visibility.

Risk Map & How to Hedge

- Title/claim risk: Work only with verifiable chains of title. Use indemnities, escrow, and insurance where available.

- Regulatory delays: Front‑load planning pre‑checks; pre‑consult NEMA and County Physical Planning; phase approvals.

- Infrastructure slippage: Buy near nodes already under construction or funded; structure purchase price in tranches tied to public‑works milestones.

- FX risk (for diaspora): Convert in tranches; hedge with forward contracts where amounts are large; keep part of the project’s cash flows in USD via tourism receipts.

- Construction inflation: Lock key materials early; design for modularity; value‑engineer specs without diluting target ADR/sales price.

Five‑Year Coastal Scenarios (2025–2030)

- Base Case: Gradual completion of dualling and utility upgrades; Malindi airport estate improvements; tourism maintains steady growth with seasonal peaks. Land values in second/third‑row zones step up 30–60% on serviced stock; prime near‑beach plots appreciate more.

- Bull Case: Faster‑than‑expected charter capacity, successful execution of access nodes/bridge works; branded residences arrive in Watamu/Kilifi. Well‑positioned serviced land doubles from 2025 baselines; villa clusters achieve high occupancy and resilient ADRs.

- Bear Case: Approval delays and slower infrastructure timelines; macro headwinds soften absorption. Raw land holds value; serviced schemes still clear with incentives; rental yields compress but remain positive in peak seasons.

How Mkaazi Real Estate Ltd Can Help (Our Edge)

- Deal Origination: Off‑market coastal parcels with clean titles—Casuarina, Silversands, Bofa, Vipingo, Mayungu–Mambrui, and inland Malindi belts.

- End‑to‑End Buy‑Side: From searches, surveys, and SPV setup to closing, handover, and basic site works.

- Servicing & Delivery: Roads, drainage, fencing, water and power points, and curated guidelines that protect long‑term value.

- Project Structuring: JV, ground leases, vendor finance, and diaspora‑friendly escrow templates.

- Asset Management: Short‑let setup, PMS onboarding, yield tracking, and owner‑use calendars.

A Diaspora Buyer’s Step‑By‑Step

- Define the brief: Target use (hold/flip/build/let), time horizon, budget, and preferred micro‑market.

- Shortlist 3–5 parcels: We supply title packs, survey maps, video walk‑throughs, and a valuation memo.

- Site confirmation: Your local proxy (or our team) verifies beacons, access, utilities, and neighbourhood context.

- SPV & escrow: Incorporate, open client account, and sign a milestone‑based Sale Agreement.

- Searches & consents: Registry search, land control consent (where applicable), rates/land rent clearance.

- Transfer & registration: Lodge documents; release funds; take possession.

- Value‑add (optional): Servicing package, show‑home, or JV operator alignment.

- Exit or hold: Sell serviced plots, retain rental units, or bank for medium‑term capital gains.

Legal & Regulatory Quick Notes

- Land Control Board (LCB): Required for agricultural land transfers in controlled areas; check ward/jurisdiction early.

- Rates & Land Rent: Ensure seller clears all arrears before transfer; collect receipts.

- Beach Access & Coastal Setbacks: Respect access servitudes and the Coast Development Authority guidelines; build within setback distances.

- Environmental (NEMA): ESIA thresholds apply to hospitality and multi‑unit schemes; plan lead times accordingly.

Frequently Asked Questions (Coast Edition)

Q1: How close to the beach is “close enough”?

Second and third rows with registered beach‑access servitudes often deliver 70–85% of beachfront value at 40–60% of the entry price. Factor in privacy, storm resilience, and servicing ease.

Q2: What plot size should I target for a villa cluster?

For 8–12 villas with shared amenities, 1.5–3 acres typically suffices, depending on setbacks, parking, and pool footprint.

Q3: Can I do Airbnb/short‑lets legally?

Yes, but align with county bylaws, tourism licensing (where required), and estate rules. Good neighbour policies matter.

Q4: How long does a clean transfer take?

With complete documents and responsive counterparties, 4–8 weeks is common. Complex chains or consents can extend timelines.

Q5: What returns are realistic?

For serviced plots, 20–40% uplift over raw land is typical; for villa clusters, blended IRRs depend on seasonality and leverage, but 14–20% is an achievable range with disciplined execution.

Sample Investment Theses (Ready to Tailor)

Thesis A — Second‑Row Villas in Silversands

Acquire 1–2 acres; design 10–14 compact villas (110–140 m²), shared pool, and concierge. Sell 50% off‑plan to de‑risk, retain 50% for short‑lets. Exit profits plus a USD‑linked income stream.

Thesis B — Serviced Plots near Bofa, Kilifi

Assemble 3–6 acres within 1–2 km of the dualling corridor. Provide graded roads, drainage, water points, and a show‑unit. Phase sales in tranches aligned to highway milestones.

Thesis C — Inland Malindi Land‑Bank (Chakama)

Acquire 5–20 acres at very low entry; secure borehole rights and simple access works. Lease for agriculture while awaiting infrastructure and population creep; consider future subdivision.

What to Send Us to Get Started

- Preferred micro‑market(s) and budget range.

- Investment horizon and income vs. capital‑gains priority.

- Willingness to participate in JV/ground‑lease structures.

- Need for financing/ vendor finance options.

We’ll convert that brief into a shortlist, valuation memo, and closing plan in days—not months.

Closing Note: The Window Is Open

The Kenyan Coast’s next leg is being built now—on roads, power, ports, and tourism capacity. Malindi sits at the centre of a corridor where entry prices still make sense and use‑cases are multiplying. For diaspora and local investors alike, this is the moment to lock in quality land, add the right services, and let time and infrastructure do the heavy lifting.

Mkaazi Real Estate Ltd

Coast & Nairobi | Buy‑Side Advisory • Land Servicing • JV Structuring

Request a tailored brief by emailing us on info@mkaazirealestate.com or Reach us directly via WhatsApp on +254 763 56 8989.