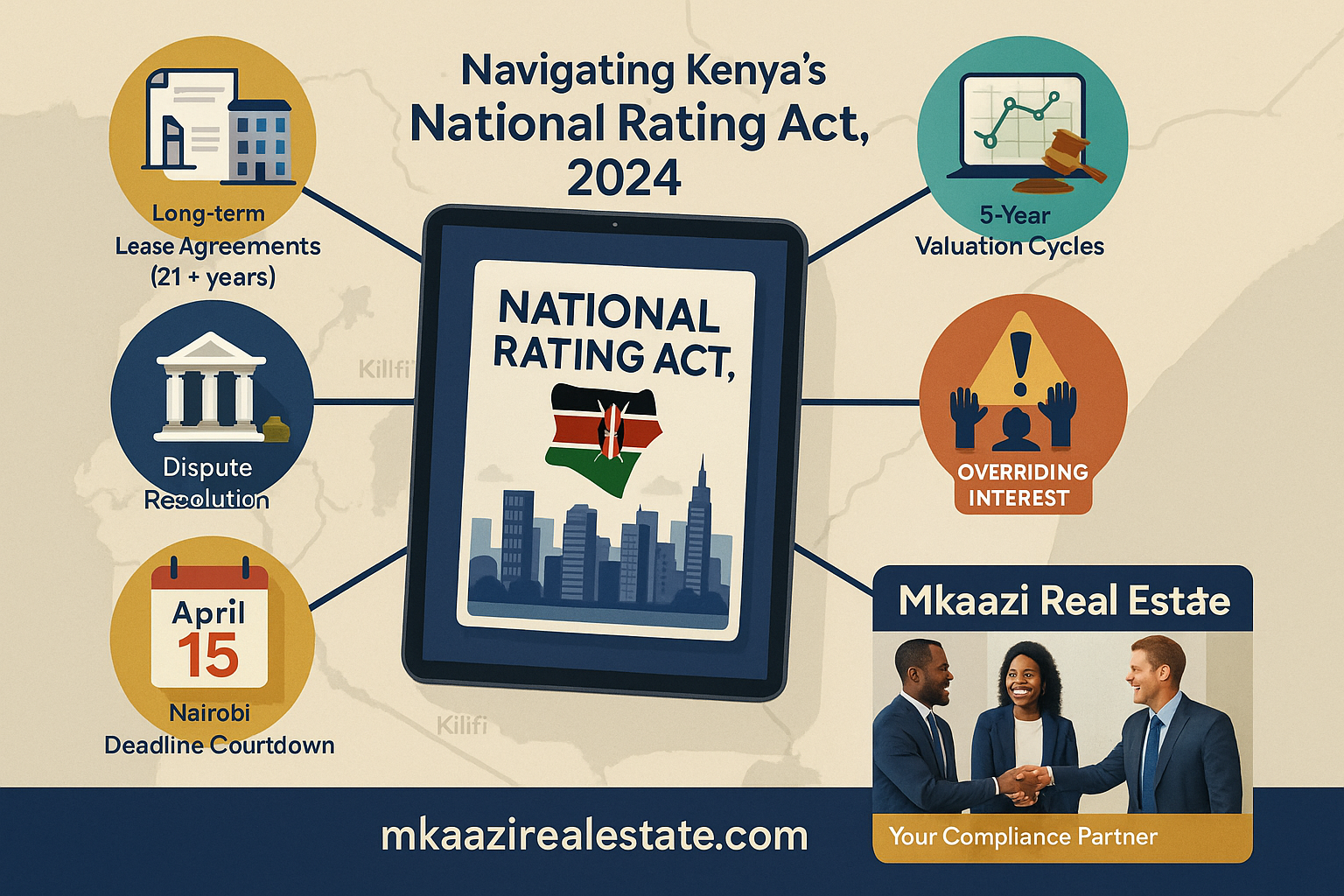

Navigating Kenya’s New National Rating Act, 2024: What Property Owners Must Know!

Introduction

As seasoned professionals in Kenya’s dynamic real estate sector, we have witnessed first-hand how legislative shifts reshape market dynamics. The National Rating Act, 2024, which came into force on 4th December 2024, is one such transformative law. Let us break down its implications and why partnering with a trusted firm like Mkaazi Real Estate Ltd—a leader in property management and advisory—is critical to navigating these changes seamlessly.

This comprehensive guide will walk you through the core components of the new law, who it affects, and how to position yourself strategically in response. From property taxation changes and valuation cycles to enforcement mechanisms and dispute resolution, we explore the new terrain step by step. By the end of this article, you will understand how to maintain compliance, manage your obligations effectively, and even turn this legislative evolution into a value-adding opportunity.

1. The National Rating Act, 2024: A Paradigm Shift

This landmark legislation repeals outdated laws like the Rating Act and Valuation for Rating Act, introducing a modern framework for land rate administration. Its core objectives? Boost county revenues, enhance transparency, and align with Kenya’s Vision 2030 goals through tech-driven efficiency.

Historically, Kenya’s land rating system suffered from inconsistency and inefficiency, causing major revenue leakages and disputes across counties. The National Rating Act, 2024, is intended to bring uniformity and clarity to a sector plagued by ambiguity and outdated valuations.

By leveraging technology, enhancing public participation, and strengthening enforcement, the Act ensures that counties are better equipped to collect revenues, plan infrastructure, and deliver public services. Moreover, its alignment with Vision 2030 and the Constitution of Kenya (2010) makes it part of a larger push toward devolution, accountability, and fiscal sustainability at the county level.

2. Key Provisions Every Property Owner Should Prioritize

The Act brings several significant changes. Here, we dissect the most impactful provisions and what they mean for property owners:

a) Expanded Tax Base: Who’s Now Liable?

Gone are the days when only “mother titles” bore the burden. The Act now targets:

- Long-term leaseholders (21+ years)

- Sectional property owners (e.g., apartment units)

This means if you own an apartment unit or a long-term lease on commercial property, you are now directly responsible for land rates, not the primary titleholder or the developer. This change increases accountability but also adds complexity to rate assessments, especially in high-density developments.

The expanded base ensures that land rates are more equitably shared among users of land, not just those holding expansive titles. It encourages individual responsibility and will likely impact how developers price and market properties moving forward. Buyers must now factor in these obligations from the outset.

b) Tech-Driven Valuations & Shorter Cycles

In line with digital transformation, counties are mandated to adopt technology-based valuation systems. These systems must comply with Kenya’s data protection laws to ensure privacy and accuracy.

What’s different?

- Valuation cycles now occur every 5 years, down from 10.

- Use of GIS (Geographic Information Systems) and digital property records will become standard.

This shift will ensure that property rates better reflect current market values. For property owners, it means being prepared for more frequent reviews and possible fluctuations in rate amounts. Staying updated and anticipating market trends will be key.

Moreover, digital valuations reduce human error, corruption risks, and discrepancies. However, they also require counties to build robust ICT infrastructure, and owners must remain vigilant against technical inaccuracies. Engaging professionals like Mkaazi ensures your property is correctly valued and assessed.

c) Public Participation: Your Voice Matters

The Act mandates counties to engage property owners in rate-setting processes. This is your chance to influence how rates are calculated.

Key avenues for engagement:

- County valuation roll hearings

- Stakeholder meetings and forums

- Submission of objections or proposals during draft phases

Public participation is not just a legal formality; it can significantly affect rate levels and methodologies. Active engagement ensures fairness and transparency. Mkaazi Real Estate Ltd provides advisory services to help clients voice their concerns constructively and participate meaningfully in these public consultations.

d) Stricter Enforcement: No Room for Default

One of the Act’s most robust provisions is the introduction of enhanced enforcement measures. Non-payment of land rates now attracts severe consequences:

- Property auctions to recover unpaid dues

- Attachment of income or assets

- Appointment of receivers

- Listing with Credit Reference Bureaus (CRBs)

Additionally, land rates are classified as an “overriding interest”, meaning they take precedence over mortgages or other encumbrances. Banks will now require rate compliance before processing sales or financing transactions.

For property owners, this means staying compliant is not optional. Defaults can halt property transactions, damage credit profiles, and lead to asset loss. Mkaazi helps clients develop proactive compliance plans and negotiates payment plans or waivers where applicable.

e) Reduced Exemptions: Who’s Affected?

Previously, many institutions enjoyed rate exemptions. Under the new Act:

- Private schools, religious institutions, libraries, and charities are no longer automatically exempt.

- Only public institutions providing non-commercial services retain exemptions, e.g., government hospitals and public cemeteries.

This means that private developers who previously avoided rates under the guise of public benefit may now be liable. Clarifying the commercial versus public nature of services is crucial.

Property owners must review their status and seek legal advice where in doubt. Mkaazi Real Estate Ltd assists institutions in compliance assessments and liaising with counties for exemption clarifications.

f) Dispute Resolution: A Two-Tier System

The Act introduces a formal dispute resolution framework:

- Stage 1: File objections with the respective County Rating Board.

- Stage 2: If unsatisfied, escalate the matter to the National Rating Tribunal.

This system aims to resolve disputes faster and more transparently than the court process.

For instance, if you disagree with a new valuation, you can file a challenge supported by expert evidence. Mkaazi provides valuation experts, legal consultants, and procedural support to strengthen your case.

3. Nairobi’s Extended Deadline: Act Now!

Nairobi County Governor Johnson Sakaja announced an extension for land rate compliance until 15th April 2025. This offers breathing room, but compliance remains low—only 20% of Nairobi’s 250,000 landowners have paid their rates.

Consequences of non-compliance post-deadline include:

- Interest penalties

- Accrual of arrears

- Legal enforcement

- Ineligibility for property transfers or development approvals

If you own property in Nairobi, take advantage of this extension to update your valuation records, settle outstanding rates, and align with the new Act.

Mkaazi Real Estate Ltd is actively supporting property owners in Nairobi with compliance clinics, workshops, and one-on-one consultations to facilitate smooth transitions.

4. Why Partner with Mkaazi Real Estate Ltd?

With over 12 years of experience and regulation under the Estate Agents Registration Board (EARB), Mkaazi Real Estate Ltd is your go-to partner for navigating this new terrain. Here’s what sets us apart:

a) Market Intelligence: We monitor county-specific rate laws and implementation schedules, alerting clients to changes and opportunities. Our insights help prevent non-compliance surprises.

b) Valuation Support: We provide periodic assessments of your property’s market value, offer guidance during county valuations, and help optimize your land rate liabilities.

c) Dispute Resolution: From lodging objections to representing clients at the National Rating Tribunal, our legal and valuation experts ensure your rights are defended.

d) Property Management: Our end-to-end services cover everything from managing leasehold responsibilities and rental income compliance to facilitating development approvals and asset transfers.

Mkaazi offers scalable packages for:

- Individual property owners

- Real estate developers

- Institutional investors

- Commercial property managers

5. Final Thoughts: Adaptability is Key

The National Rating Act, 2024, marks progress but demands adaptability. Whether you own a 150-acre ranch in Kajiado, a sectional unit in Kilimani, or a beachfront apartment at Kilua Beach Resort, the landscape has changed.

Stay informed. Partner with professionals. Be proactive.

Regulatory change should not be feared but managed. With the right support, compliance can become an opportunity to improve record-keeping, boost your property’s appeal, and secure investment stability.

Mkaazi Real Estate Ltd stands ready to guide you. Visit us at mkaazirealestate.com or WhatsApp our team on +254 763 568989 for tailored solutions. Together, let’s turn legislative challenges into opportunities for growth.

Your trusted partner in Kenyan real estate, Mkaazi Real Estate Ltd